Traders of Environmental Progress

STX Group is a global environmental commodities trader offering physical and financial solutions across compliance and voluntary systems for energy, fuels, gas and carbon markets.

Blog Articles

The US Inflation Reduction Act (IRA) has introduced significant incentives for renewable energy production. Among these, the 45V Hydrogen Tax Credit stands out as a pivotal tool aimed at boosting low-carbon hydrogen production. This tax credit is particularly geared toward encouraging production of renewable hydrogen by using carbon capture, utilization, and storage (CCUS) and renewable electricity.

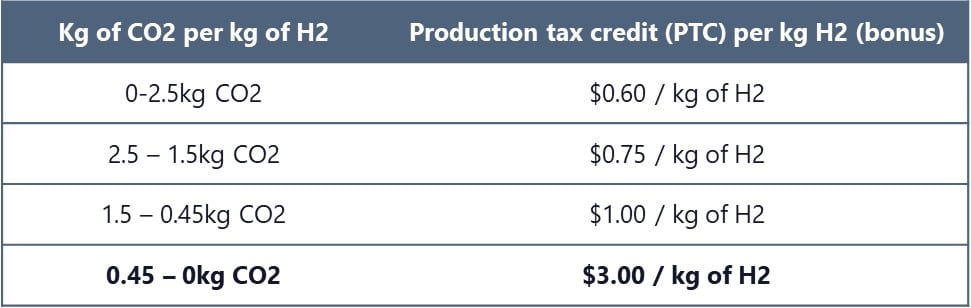

At its core, the 45V Hydrogen Tax Credit provides incentives based on the carbon intensity of the hydrogen production process. Carbon intensity refers to the amount of carbon dioxide emissions produced per unit of hydrogen generated. As outlined in the IRA, producers can receive up to US $3 per kilogram of hydrogen produced, with the amount determined by kilograms of CO₂ emitted per kilogram of hydrogen.

This approach not only incentivizes the reduction of carbon emissions but also supports a wide range of technologies and methods in hydrogen and ammonia production.

Scale of incentives based on carbon intensity of the hydrogen production process:

Green and blue hydrogen both qualify for 45V incentives, but maximizing these benefits requires a focused environmental strategy and the use of different environmental products.

Green hydrogen is produced by electrolysis, where electricity splits water into hydrogen and oxygen. This process is considered ‘green’ when the electricity used is sourced from renewable energies like solar, wind, or hydro power, enabling hydrogen production without any greenhouse gas emissions. To maximize 45V credits, producers of green hydrogen should utilize renewable electricity solutions such as Renewable Energy Certificates (RECs), Power Purchase Agreements (PPAs), or Virtual Power Purchase Agreements (VPPAs). These solutions must meet specific criteria:

Like grey hydrogen, blue hydrogen is generated from natural gas being split into hydrogen and carbon dioxide either through steam methane reforming (SMR) or autothermal methane reforming (ATR). The key difference between grey hydrogen and blue hydrogen production is that, in blue hydrogen, the greenhouse gas emissions are (partially) captured – resulting in a lower carbon footprint. Although not completely emissions-free like green hydrogen, blue hydrogen offers a more sustainable alternative to grey hydrogen. Blue hydrogen production can also use renewable sources of methane (e.g., biomethane) as input, further reducing its carbon footprint.

While the US Treasury has yet to finalize guidance and approval on the eligibility of Renewable Natural Gas (RNG) for 45V tax credits, utilizing RNG could be key to maximizing these benefits. By blending RNG with traditional natural gas in the production of renewable Hydrogen, producers may be able to significantly reduce their carbon footprint and qualify for the maximum tax credit of $3.00 per kilogram of hydrogen. This strategy highlights the importance of selecting the right blend and source of RNG to optimize the financial and environmental benefits.

Beyond the 45V tax credits, producers can also leverage California’s Low Carbon Fuel Standard (LCFS) credits, further enhancing the economic viability of low-carbon hydrogen production. Moreover, compliance with corporate voluntary disclosures and product certifications like ISCC and REDcert becomes pivotal in navigating the regulatory landscape and maximizing the benefits of renewable energy production for export outside of the US.

The IRA’s 45V tax credits mark a pivotal moment for the US energy sector, driving forward the adoption of renewable hydrogen and ammonia production. As the Treasury finalizes its guidance, there is a significant opportunity for producers to either integrate Renewable Natural Gas (RNG) into their operations or to invest in renewable electricity solutions such as RECs, PPAs, or VPPAs. The strategic inclusion of RNG not only leverages the value from emissions reductions but also plays a crucial role in qualifying for maximum tax credits.

Navigating the complexities of adopting RNG involves critical choices around the selection of the right RNG blend and understanding its carbon intensity (CI), while ensuring compliance with regulatory standards. Tools and models, such as those developed by STX Group, are essential for guiding these decisions, enabling producers to optimize both environmental impact and financial returns.

STX Group is uniquely positioned to support industry partners in the hydrogen sector by providing access to mature product portfolios including RECs, PPAs, RNG and corporate tax credit buyers. Selecting the right products can be complicated in OTC markets and in uncertain regulatory environments.

Our specialized trading desks offer flexible transaction structures tailored to various risk profiles and comprehensive solutions for decreasing product carbon intensity (CI) while optimizing tax credit monetization.

Contact us to begin leveraging the 45V incentive and build a strategy aligned with your renewable hydrogen or ammonia goals.