Traders of Environmental Progress

STX Group is a global environmental commodities trader offering physical and financial solutions across compliance and voluntary systems for energy, fuels, gas and carbon markets.

Blog Articles

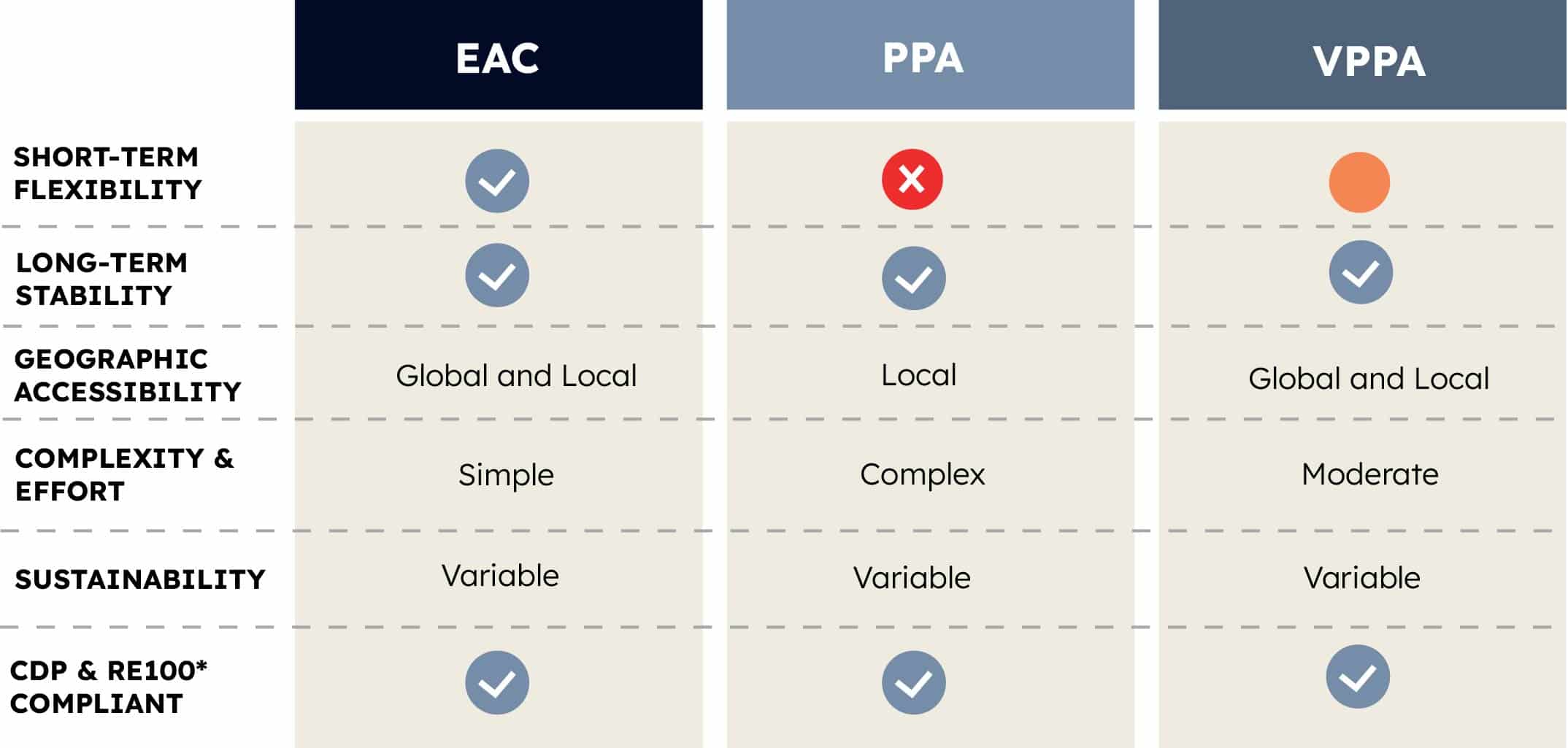

Power Purchase Agreements (PPAs) are revered for their direct engagement with renewable energy producers. They offer a long-term stable commitment to purchasing electricity from specific facilities. By entering a PPA, a company effectively supports renewable energy projects and secures a fixed price for the energy generated.

PPAs gained popularity among companies with large electricity usage such as tech firms with expanding data center networks looking to reduce their Scope 2 emissions. However while PPAs promise stability they often come with lengthy contractual commitments (up to 25 years), potential geographical limitations tied to the energy source’s proximity, and risks associated with market fluctuations.

Virtual Power Purchase Agreements (VPPAs) emerged as a strategic response to some limitations of traditional PPAs. As PPAs deliver both the environmental attribute and physical power, VPPAs allow those without proximity to the generation source to share the benefits of long-term renewable electricity investment agreements.

Most VPPAs structure the volume as “pay as produced.” That means that financial aspects like the price hedge and green claim depend on the actual production volume of the renewable asset. The buyer commits to a variable amount of renewable energy over a set period, tying financial commitment to actual energy output. This structure offers flexibility, since obligations are based on energy generated.

It ensures a direct link between produced volume and the buyer’s financial benefits and environmental claims, promoting transparency and alignment of buyer and project performance.

Download your copy now of Recent trends in the renewable electricity markets

Energy Attribute Certificates (EACs), or Renewable Energy Certificates (RECs) in North America, represent the environmental attributes of energy generated from renewable sources, separate from physical electricity.

Unlike PPAs and VPPAs, EACs offer unmatched flexibility. Companies can procure renewable attributes independently of geographical constraints, not tied to specific facilities. Flexibility and ease of procurement characterize EACs, making them accessible for companies of various sizes and structures. EACs allow businesses to reduce their carbon footprint without long-term contracts or direct engagement with energy producers, though some EACs can be hedged for periods up to 10 years.

In planning sustainable energy sourcing it is crucial to act proactively regardless of your chosen path. There is growing consensus that carbon prices will rise which could make sustainability commitments harder and costlier to maintain.

However with 2030 approaching there are tools and opportunities to reduce emissions without compromising core business goals. Instead of relying on one-time RFPs, consider long-term partnerships with sustainability experts who can guide optimization of investments over time. Many clients find that large RFPs (for example over $200,000 notional) can move market pricing unfavorably if released without market-aware strategy.

Working with a market expert like ours on hedging strategies, such as our solutions, when procuring renewable electricity helps protect your business from market fluctuations and financial risks.

We understand the challenge of meeting substantial energy demands without compromising fiscal responsibility. At STRIVE by STX, we guide companies toward self-sufficiency in renewable electricity sourcing, facilitating a transition to comprehensive decarbonization while ensuring additionality. Start your climate conversation with our experts to jointly build an optimized renewable electricity procurement strategy for your organization.